How serious are the flaws in the SEC’s new crypto rules? Pretty darn serious, according to Commissioner Crenshaw, who isn’t mincing words about the agency’s recent guidance on meme coins. She’s calling it an “incomplete, unsupported view of law” that could create a massive regulatory loophole. Not exactly a ringing endorsement from someone on the inside.

The commissioner’s critique cuts to the heart of the matter: the guidance lacks even a basic definition of what constitutes a meme coin. Seriously? How can you regulate something you can’t define? She argues that the SEC staff has fundamentally misapplied the Howey test, potentially allowing profit-seeking ventures to dodge securities laws simply by slapping a “meme coin” label on their tokens.

It gets worse. Crenshaw points out that this guidance fails to take into account the economic realities behind most meme coins. These aren’t just innocent jokes – they’re often deliberately designed to make money for their creators. The guidance conveniently overlooks this profit-seeking nature, creating what amounts to a get-out-of-regulation-free card.

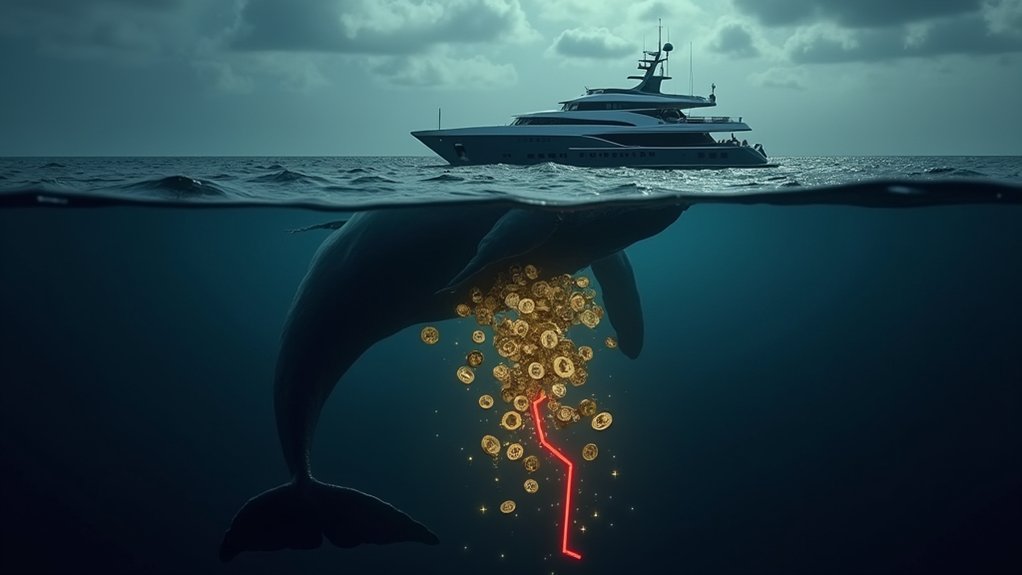

Meme coins aren’t jokes—they’re profit schemes hiding behind cartoon mascots while regulators look the other way.

The timing couldn’t be more problematic. This regulatory confusion arrives just as crypto firms are desperate for ways to avoid SEC oversight. The SEC’s troubling approach of regulation-by-enforcement rather than providing clear rules has created significant ambiguity in the market. This ambiguity has helped fuel the explosive market growth from $200 billion in 2023 to $1.4 trillion in 2024. You better believe they’re noticing this potential loophole. Expect a flood of new “meme coins” that are suspiciously well-organized money-making operations.

For investors, particularly retail buyers who lack financial sophistication, the dangers are real. Without proper oversight, the price volatility in meme coin markets leaves them especially vulnerable to manipulation and scams. Without proper disclosure requirements or regulatory oversight, they’re walking into a minefield blindfolded. Who needs investor protection anyway, right?

The contradictions here are glaring. After years of aggressive crypto enforcement, the SEC suddenly creates this bizarre carve-out that undermines its own authority. It’s no wonder Crenshaw is calling for extensive crypto guidelines and a consistent application of securities laws.

The alternative is a regulatory mess that serves nobody – except perhaps those looking to exploit the system.