Proof of Work (PoW) and Proof of Stake (PoS) are two different ways to validate cryptocurrency transactions. PoW requires miners to solve complex math puzzles using powerful computers, while PoS lets people validate transactions by putting up their own coins as collateral. PoW uses lots of energy and expensive equipment, but PoS is more energy-efficient and faster. Both systems aim to keep networks secure, but they take different paths to reach this goal. There's much more to discover about how these systems shape the future of digital currencies.

While cryptocurrency networks use different methods to validate transactions, two of the most popular approaches are Proof of Work (PoW) and Proof of Stake (PoS). These systems differ in how they process and verify transactions on the blockchain. In PoW, miners compete against each other to solve complex mathematical puzzles, while PoS operates more like a lottery system where validators are chosen based on how many coins they've staked. Mining rewards incentivize participants to maintain network security and process transactions accurately. Failed validation in PoS results in a stake penalty, making validators think twice before attempting fraudulent activities.

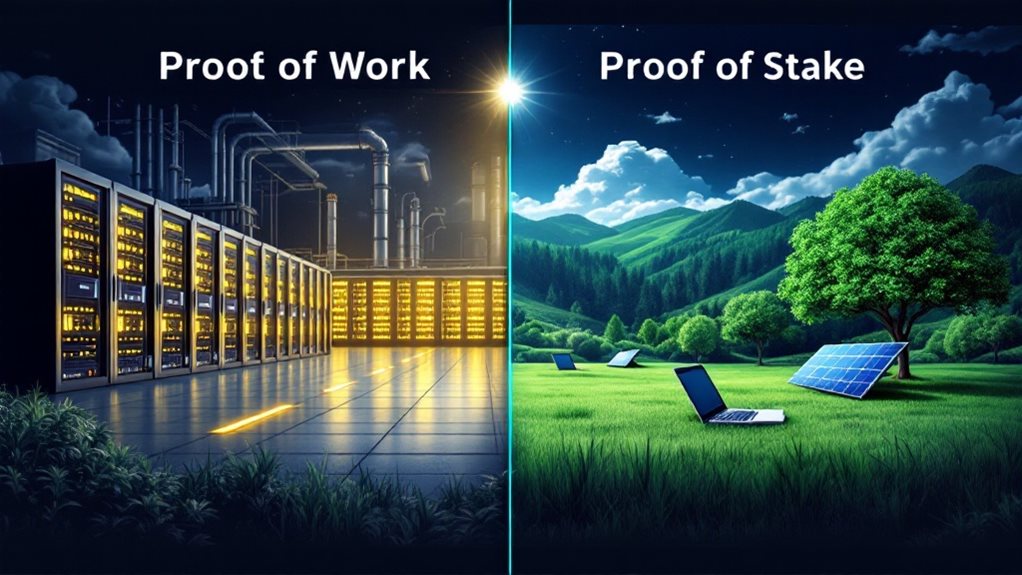

The energy consumption between these two systems shows a stark contrast. PoW requires massive amounts of computational power, using as much electricity as some countries. This high energy usage has led to environmental concerns and criticism from various groups. On the other hand, PoS is much more energy-efficient since it doesn't need powerful computers solving puzzles. Instead, it relies on validators who've locked up their coins in the network. The lower hardware requirements of PoS systems allow for broader participation in the validation process.

When it comes to security, both systems aim to protect the network but do so differently. PoW's security comes from the tremendous computational effort required to add new blocks, making it extremely difficult and expensive to attack the network. PoS secures the network through economic incentives, as validators must stake their own coins and risk losing them if they try to cheat the system. The native tokens are distributed to validators who successfully verify and add blocks to maintain network integrity.

The two systems also differ in how they handle network growth and transaction processing. PoS typically offers better scalability and can process transactions faster than PoW networks. As PoW networks grow larger, they often face challenges with transaction speeds and network congestion. PoS systems can more easily implement additional scaling techniques to improve their performance.

Decentralization remains a key consideration for both systems. PoW initially promotes a more decentralized network as anyone with computing power can participate. However, over time, mining often becomes concentrated among those who can afford specialized equipment. Similarly, PoS systems may face issues with wealth concentration, as those with more coins have a greater chance of being chosen as validators.

These different approaches to blockchain validation continue to evolve as the cryptocurrency industry matures. While PoW has proven its reliability through Bitcoin's success, PoS has gained popularity due to its energy efficiency and scalability benefits. Each system has its own strengths and continues to serve different purposes within the cryptocurrency ecosystem.

Frequently Asked Questions

Which Consensus Mechanism Consumes Less Electricity During Network Maintenance?

Proof of Stake (PoS) clearly uses way less electricity than Proof of Work (PoW) for maintaining crypto networks.

The numbers don't lie – PoS uses 99.95% less energy than PoW systems.

While Bitcoin's PoW network uses more electricity than entire countries like Finland, PoS networks like Polkadot only use about as much power as 200 US homes annually.

That's a huge difference in energy consumption.

Can Mining Rewards Be Shared Among Multiple Participants in Either System?

Yes, mining rewards can be shared in both systems.

In Proof of Work, miners join mining pools where they combine their computing power and split the rewards based on their contribution.

In Proof of Stake, token holders can delegate their coins to validators and share in the staking rewards.

Both methods help smaller participants earn more consistent returns instead of trying to earn rewards on their own.

Which System Provides Better Protection Against 51% Attacks?

Both systems offer strong protection against 51% attacks, but they work differently.

PoW relies on massive computing power and high energy costs to deter attackers. PoS uses financial stakes and penalties to prevent attacks.

While PoW has a longer track record of security, PoS can be more cost-effective.

Smaller PoW networks are more vulnerable to attacks, while PoS faces risks from stake concentration.

Neither system is completely immune to attacks.

How Do Transaction Fees Differ Between Pow and Pos Networks?

Transaction fees are typically higher in PoW networks due to energy costs and network congestion.

Bitcoin's average fee is around $2.15, while PoS networks like Stellar charge just fractions of a penny.

PoS systems can handle more transactions efficiently, which helps keep fees low.

When networks get busy, PoW fees tend to spike more dramatically than PoS fees.

The lower costs of running PoS networks are passed on to users through cheaper transactions.

Is It Possible to Switch Between Pow and Pos Mechanisms?

Yes, it's possible to switch between PoW and PoS mechanisms through a process called a hard fork.

Ethereum proved this in 2022 with "The Merge," successfully shifting from PoW to PoS.

However, it's a complex change that needs significant code updates and network support.

The switch requires careful planning, community agreement, and extensive testing.

During the changeover, networks must manage potential risks and guarantee all participants are ready for the alteration.