Hardware and software wallets each serve different cryptocurrency needs. Software wallets are free, user-friendly apps that work well for frequent trading and smaller amounts. Hardware wallets cost $40-$200 but offer stronger security by storing crypto offline, making them ideal for large, long-term holdings. Some investors use both: software wallets for daily transactions and hardware wallets for secure storage. The best choice depends on trading habits, security priorities, and budget considerations.

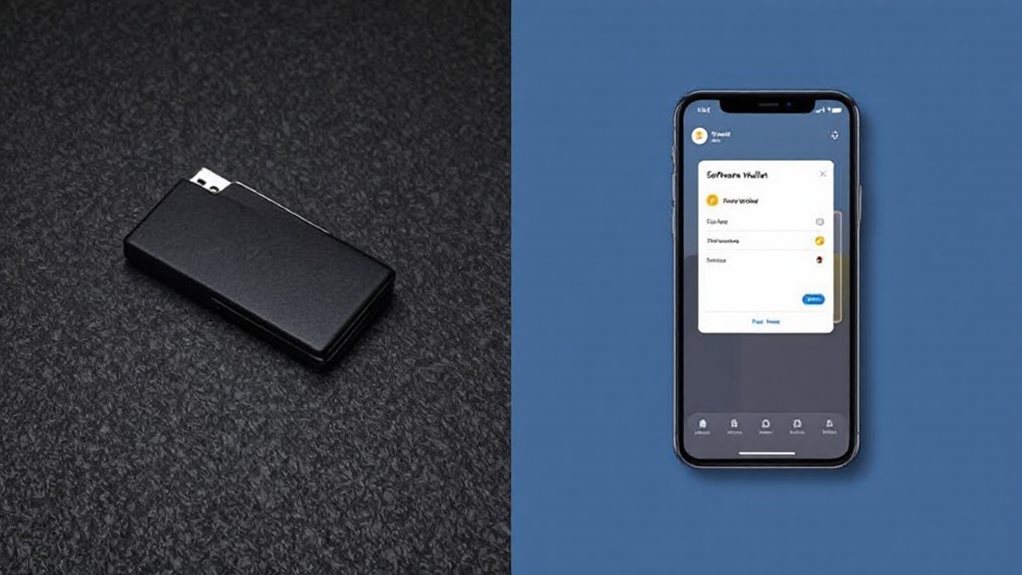

While cryptocurrency investors have many options for storing their digital assets, the choice often comes down to two main types of wallets: hardware and software. These two storage solutions offer different features and levels of security for managing digital currencies. Unlike regular wallets, these solutions store private cryptographic keys that grant access to digital assets on the blockchain.

Hardware wallets are physical devices that keep private keys stored offline in a secure chip. They're specifically designed to protect cryptocurrency from online threats and require users to physically confirm transactions by pressing buttons on the device. Though they cost more, with prices ranging from $40 to over $200, they provide enhanced security features that many investors find worthwhile. Most hardware wallets include tamper-proof designs to prevent physical manipulation of the device. These devices protect against unauthorized transactions through secure elements that make physical attacks extremely difficult. Popular brands like Ledger and Trezor dominate the hardware wallet market with proven security track records.

Software wallets, in contrast, store private keys on internet-connected devices like phones or computers. They're typically free or low-cost and offer convenient features like integrated exchange functionality. Users can easily access their funds and make transactions from multiple devices, making them practical for everyday use.

The security differences between these wallet types are significant. Hardware wallets are considered safer for storing large amounts of cryptocurrency because they're resistant to malware and viruses. They use PINs and recovery phrases for additional protection.

Software wallets, however, remain constantly exposed to online risks and are vulnerable to hacking, malware, and phishing attempts. If someone steals the device containing a software wallet, they might gain access to the stored cryptocurrencies.

When it comes to usability, software wallets tend to be more user-friendly and accessible for beginners. They don't require learning how to use a new physical device, and they support a wider range of cryptocurrencies. Users can quickly check balances and make transactions without additional steps.

Hardware wallets, while more secure, have a steeper learning curve and aren't as convenient for daily transactions.

The choice between hardware and software wallets often depends on an investor's specific needs. Software wallets shine in situations requiring frequent trading or transactions, offering quick access and broad cryptocurrency support.

Hardware wallets excel at securing larger amounts of cryptocurrency for long-term storage, providing peace of mind through their offline security features. Both types serve different purposes in the cryptocurrency ecosystem, with some users opting to use both: hardware wallets for long-term storage and software wallets for day-to-day transactions.

Frequently Asked Questions

Can I Restore My Wallet if My Device Breaks or Gets Lost?

Yes, a broken or lost device doesn't mean someone's crypto is gone forever.

The most common recovery method uses a seed phrase – a set of 12-24 words created when first setting up a wallet. As long as they've kept this phrase safe, they can restore their wallet on a new device.

For hardware wallets, they'll need to buy a replacement device. For software wallets, they can reinstall the app on another device.

Are Hardware Wallets Worth the Investment for Small Cryptocurrency Portfolios?

For small cryptocurrency portfolios under $1,000, hardware wallets might not be cost-effective.

These devices typically cost between $40 and $200+, which can be a significant portion of a small investment. Many people with smaller portfolios use software wallets, which are free.

However, as portfolios grow in value, hardware wallets become more practical. Their security features protect against online threats and hacks, making them popular for larger investments.

How Often Should I Update My Wallet's Software for Security?

Cryptocurrency wallet software should be updated monthly at minimum, though many users opt for automatic updates.

Updates patch security holes and add new features that keep wallets working properly. Most wallet providers send notifications when important updates are available.

Security experts note that outdated wallet software can leave funds vulnerable to cyber threats. Some wallets won't work correctly with newer blockchain features if they're not kept current.

Can I Store Multiple Types of Cryptocurrencies in One Wallet?

Yes, many modern crypto wallets support multiple cryptocurrencies in a single interface. These are called multi-currency wallets.

Hardware wallets like Ledger Nano X can handle over 5,500 different cryptocurrencies, while software wallets like Exodus manage more than 100 crypto assets.

It's like having different types of money in one digital wallet. Popular options include Trust Wallet, Atomic Wallet, and MetaMask, which each support various cryptocurrencies and tokens.

What Happens to My Crypto if the Wallet Company Goes Bankrupt?

If a wallet company goes bankrupt, what happens to someone's crypto depends on the type of wallet they're using.

With hardware wallets, nothing changes – the crypto stays safe because it's stored offline.

With software wallets, it's different. Non-custodial software wallets keep working fine, but custodial wallets (where the company holds the private keys) might freeze funds during bankruptcy proceedings.

The user's access could be affected if the company's servers shut down.