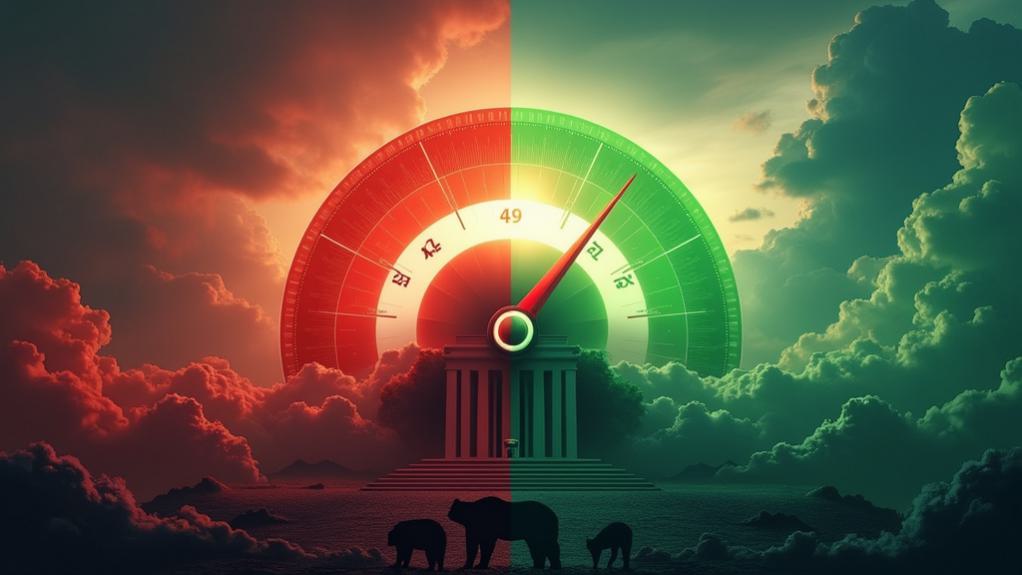

Emotions drive the crypto market—sometimes to dizzying highs, other times to crushing lows. The Crypto Fear and Greed Index just jumped 17 points to reach 49, moving from “Fear” territory to the edge of “Neutral.” All because the Federal Reserve made another interest rate decision. Crypto traders, predictably, reacted.

Created by alternative.me in 2018, this index measures market sentiment on a scale from 0-100. Zero means everyone’s panicking. One hundred means investors are practically throwing money at their screens. It’s updated daily at 8:00 UTC, giving traders a psychological snapshot of what’s happening.

The index isn’t just pulling numbers from thin air. It weighs several factors: volatility (25%), market momentum and volume (25%), social media chatter (15%), Bitcoin dominance (10%), market trends (10%), and surveys (15%)—though the survey component is currently on pause. This numerical approach provides an empirical method for evaluating market conditions without emotional bias. Because crypto needed more uncertainty, right?

When the index hits extreme fear (0-24), contrarian investors often see buying opportunities. When it swings to extreme greed (75-100), many consider selling. The market loves to punish the majority. During the COVID crash in March 2020, the index bottomed out at 10. During 2021’s bull run, it soared to 95. Emotions, everywhere.

The current reading of 49 represents a significant shift in market sentiment. For much of 2022’s bear market, the index was stuck in “Extreme Fear,” while 2021 mostly saw readings in the “Greed” range. That’s crypto for you—emotional whiplash on a daily basis. This sentiment oscillation demonstrates how human psychology profoundly impacts price movements beyond fundamental analysis. Low interest rates from traditional banks often push the index toward the greed side as investors seek higher returns in cryptocurrency markets.

The crypto market dances between panic and euphoria, with investors swinging from hiding under beds to popping champagne—often within the same month.

Critics point out the index’s limitations. It’s heavily Bitcoin-focused and can remain in extreme ranges for extended periods. Sometimes it moves quickly, sometimes it doesn’t. Like all indicators, it shouldn’t be used alone for trading decisions.

But it does capture something real: the raw, unfiltered psychology driving one of the world’s most volatile markets.